Texas Alliance of Energy Producers

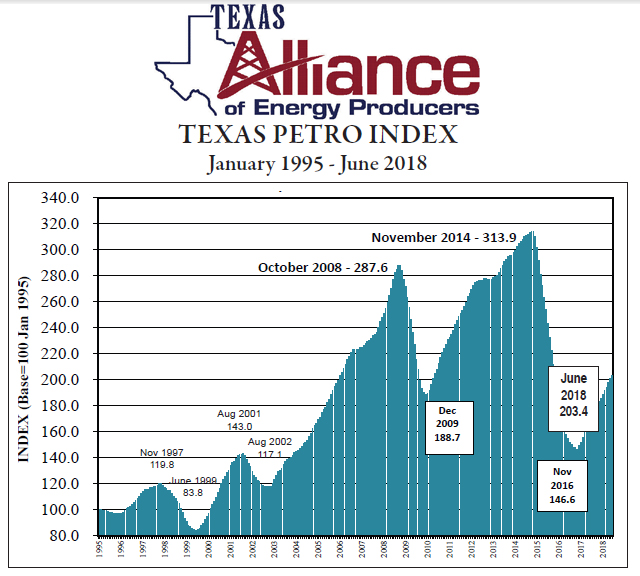

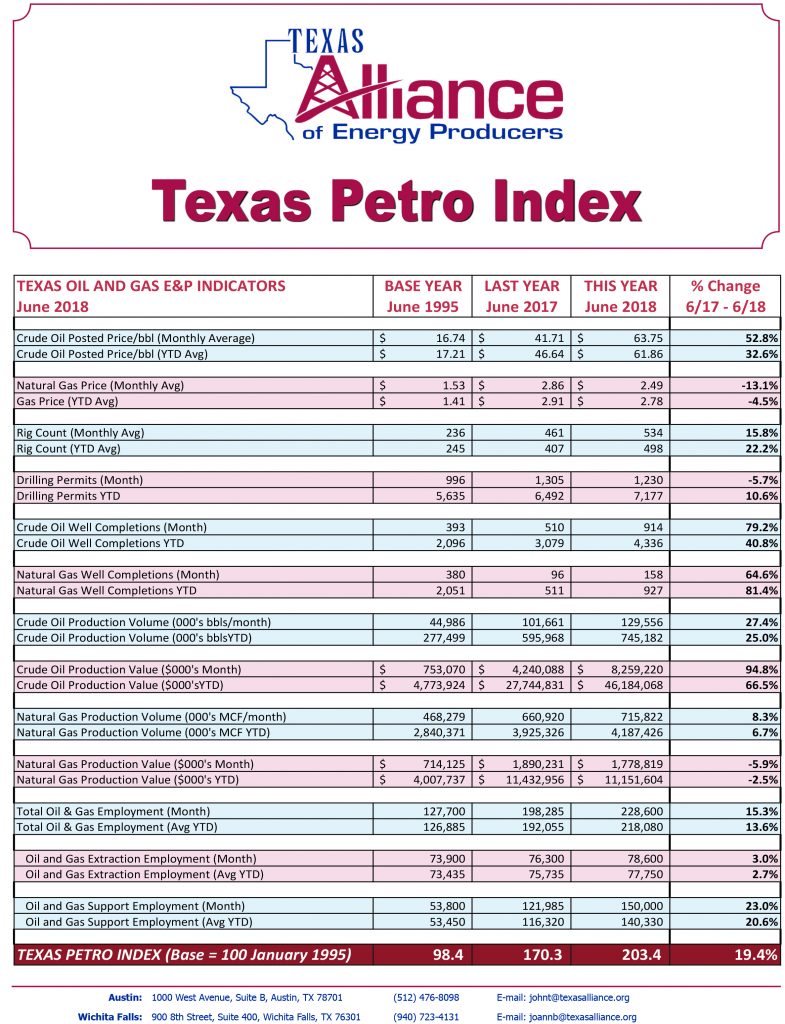

The Texas upstream oil and gas economy continues its remarkable expansion through mid-year 2018, with the Texas Petro Index increasing for the 19th straight month to 203.4 in June, up from 200.7 in May and up 19.4% from the June 2017 TPI of 170.3. The Texas Petro Index is a measuring device, tracking growth rates and business cycles in the Texas oil and gas E&P economy, developed for the Texas Alliance of Energy Producers by Alliance Petroleum Economist Karr Ingham. The TPI is based at 100.0 in January 1995.

“We’ve seen extraordinary expansions in Texas oil and gas activity over the 23-year history of the Texas Petro Index,” said Ingham. “What makes this one unique is the sheer amount of crude oil and natural gas produced in the state – and the growth rates in production – at lower levels of activity compared to the peak levels from the previous growth cycle.” Oil and gas prices, the statewide rig count, drilling permits, well completions, and employment are all on the rise but continue to lag behind the pinnacles established in 2014, said Ingham; however, crude oil production has moved into all-time record territory in 2018, surpassing 4 million barrels a day, and both crude oil and natural gas production will easily set new annual production records in 2018.

Texas crude oil production surpassed 4 million barrels per day in February, and reached an estimated 4.3 million barrels per day in June, an increase of over 27% compared to June of a year ago. Midway through the year, Texas operators have produced an estimated 745.2 million barrels of oil, up by 25% compared to the first six months of 2017. The June monthly average crude oil price, while up by over 50% compared to year-ago levels at $63.75 (West Texas Intermediate posted price), remains significantly lower than price levels in 2014 in advance of the collapse in prices. The posted WTI price averaged $101.68 in June 2014.

Natural gas production has grown more slowly, mostly because producers are not actively drilling for natural gas in Texas.

“About 92% of the active rigs in Texas are drilling for crude oil,” said Ingham. “Natural gas production growth is largely accidental at this point, produced from wells that are drilled to produce crude oil.” Over 35% of Texas natural gas production is classified by the Railroad Commission as “casinghead gas”, or gas associated with crude oil production, he said. “Natural gas production growth is not the current goal of Texas oil and gas producers, and continued production expansion is pushing prices lower, especially in the Permian where the takeaway capacity for that gas is increasingly insufficient.” The rising shortage in Permian natural gas takeaway capacity has widened the negative differential between Waha hub (Permian) gas pricing by as much as a dollar/mcf or more compared to the Henry Hub and the Houston Ship Channel, said Ingham.

The statewide monthly average rig count has improved from a cyclical low point of 182 (and a weekly low point of 173) in May 2016 to 534 in June; however, the June 2018 monthly average is 370 rigs lower compared to the peak monthly average of 904 in November 2014. “It simply takes fewer rigs and fewer people to produce ever higher amounts of crude oil and natural gas,” said Ingham. “The efficiencies achieved by Texas oil and gas producers, service companies, and drilling companies are nothing short of stunning, and in part were borne of necessity during the deep contraction of 2015 and 2016. But this is what all industries strive to do – produce more with less and at lower costs. The Texas oil and gas industry has been enormously successful at accomplishing these productivity gains to the great benefit of the American consuming public,” Ingham said.

The number of direct upstream oil and gas jobs (oil and gas extraction, service, and drilling companies) stands at an estimated 228,600 jobs in June. As of midyear 2018, about 47,000 jobs have been added back to upstream oil and gas company payrolls following the loss of over 115,000 jobs over the course of the downturn. “Jobs have certainly been added back in the current expansion, and job growth continues moving into the second half of 2018,” Ingham said. “But again, estimated upstream oil and gas employment as of June 2018 is down by over 68,000 jobs compared to peak industry employment levels in late-2014, and still crude oil production is at record levels and continues to climb.”

The number of drilling permits issued in Texas through June is up by over 10% compared to year-ago levels, but also remains well below the number of permits issued midway through each year 2011-2014.

Texas continues to dominate the upstream energy landscape in 2018. At the midpoint of 2018, Texas contributes fully 40 percent of US crude oil production and 30% of US natural gas production. Over 50% of the working rigs in the US are in Texas, and nearly 54% of all US direct upstream oil and gas jobs are in Texas.

As Texas oil and gas employment relative to total production has shrank the share of total Texas payroll employment comprised by upstream oil and gas employment has diminished as well. June estimated direct upstream oil and gas employment makes up about 1.7% of total employment, from 2.5-3%.

ABOUT the TPI:

The Texas Petro Index is a service of the Texas Alliance of Energy Producers, the nation’s largest state association of independent oil and gas producers and allied companies. For additional information, please contact Karr Ingham at 806-373-4814 / karr@inghamecon.com or John Tintera, President of the Texas Alliance of Energy Producers, at 512-476-8098 / johnt@texasalliance.org.