Contributor: Bob Mcilvaine

The U.S. market for slurry pumps has changed substantially over the last decade. Opportunities at coal fired plants have been more than replaced by activity in hydraulic fracturing. The sand used for fracturing is now being manufactured with processes which use multiple slurry pumps.

The shift from coal fired power to hydraulic fracking also resulted in a change in market share by pump type. Large centrifugal pumps are needed for coal fired plant FGD. KSB (GIW) and Weir have been two suppliers who could supply pumps large enough to deal with scrubber recycle volumes as high 400,000 gpm. Even with the largest pumps available as many as eight pumps were needed for each new plant. Recent entries include Düchting with a ceramic pump. Chinese suppliers have entered the market primarily within China.

In hydraulic fracturing reciprocating plunger pumps are used to propel a mixture of water, sand and chemicals into a well at pressures as high as 15,000 psi, and flow rates at times above 100 barrels per minute.

The market shares and participants are also changing. Weir was a major supplier at the height of the coal fired activity in the U.S. and is also a leader in fracking pumps. Gardner Denver is a fracking pump leader but was not involved with the FGD centrifugal pumps.

The mix of decision makers is also changing. There has always been some split between end users and EPC/AEs. For coal fired power large owners such as Southern and AEP made pump selections. Smaller utilities relied on Sargent & Lundy, Burns & McDonnell, Bechtel and Black, & Veatch for guidance. Coal fired generator plant providers such as Babcock & Wilcox, Foster Wheeler, Combustion Engineering (now GE) and Babcock Power supplied the FGD systems along with the balance of plant and were major pump decision makers. Since the U.S. market is primarily replacement, the owners are now the major decision makers. Several of the largest utilities have retained most of their coal fired capacity whereas others such as BHE are phasing out coal. So a few large utilities will be making most of the decisions.

The exception would be the decisions being made by third party operators. NAES operates a number of coal fired as well as gas turbine power plants for U.S. utilities. It is a subsidiary of ITOCHU of Japan. So it is a significant pump decision maker for the world power industry. Boqi in China has taken advantage of the new Chinese government support of third party operation of power plants to insure that they operate with the lowest possible emissions. Boqi is expanding beyond China to offer third party operations of air pollution control system worldwide. This raises the question as to whether Chinese third party operators could be making pump decisions for U.S. power plants.

JET, a Chinese supplier of ammonia based FGD systems, thinks so. They have hired Neal Bush (brother of the former president) and have the support of a number of lawmakers regarding a proposal to own and operate ammonium sulfate fertilizer plants in Illinois. The systems would be built at power plants using local high sulfur coals.

Even though U.S. coal fired power plant capacity will shrink to about 70 percent of its peak over the next 20 years, the amount of flyash which could be produced for cement and other beneficial uses will rise. There are over 1.7 billion tons of flyash which is in impoundments or landfills and will be a major source of product in the future. (1) Pumps are required for the dewatering and processing of the impounded flyash.

Hydraulic fracturing decisions are being made by companies such as ExxonMobil and Chevron. These two oil and gas companies are altering their investment plans to focus on oil from shale. They believe that the U.S. will be producing 25 million bbl/day of oil in eight years. This contrasts to IEA and OPEC who are forecasting U.S. production of only 14 bbl/day in 2027.

The suppliers of the fracturing pump trucks are important decision makers. Schlumberger is an integrated supplier. It has been purchasing and building manufactured frac sand plants. So it makes decisions on the pumps used to deliver the slurry to the front of the wet sand processing plant and then the pumps used with the dewatering equipment. Schlumberger also supplies the fracturing trucks with pumps.

The Chain Effect of Expanded Oil and Gas Production

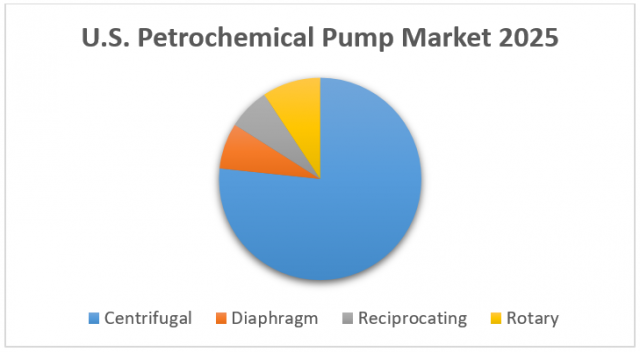

If ExxonMobil and Chevron are right and the U.S is producing liquids at costs below $30/bbl in quantities approaching 25 million bbl/day the downstream impact on the slurry pump market will be significant. Companies such as Shell are investing huge sums of money to build feedstock processing plants taking advantage of the ethane in the gas being extracted in the Marcellus region. Others are investing in LNG liquefaction facilities. The refining industry is expanding and so is the petrochemical industry who will be making more intermediates resulting in more end products such as polyethylene. These lower cost end products will boost construction of plants which use them in their process equipment. These same plants will benefit from lower energy costs. So prospects are bright for about half the traditional market. Petrochemical pump sales in the U.S. are predicted to reach $300 million in 2025. (2)

Much of the U.S. market will continue to be outstripped by off shore activity. Coal fired power, mining, steel, and some other heavy users of slurry pump will continue to expand in the growing Asian and African markets.

Much of the U.S. market will continue to be outstripped by off shore activity. Coal fired power, mining, steel, and some other heavy users of slurry pump will continue to expand in the growing Asian and African markets.

One concern for U.S. based pump suppliers is the eventual penetration of the U.S. market by suppliers who have grown through Asian activity. Consider that Sinopec is now a manufacturer of slurry pumps. The company has an office in Houston and is supplying fracking trucks using Sinopec pumps to the U.S. oil and gas industry. This is a challenge which needs to be addressed.

The U.S. slurry pump market is undergoing significant change. It is a challenge and opportunity for pump suppliers.

- Utility E-Alert published by the McIlvaine Company

- Pumps: World Market published by the McIlvaine Company