This is a report on announced fluid handling industry merger and acquisition transactions for 2013. The report is compiled by Global Equity Consulting, LLC and City Capital Advisors. Global Equity Consulting and City Capital Advisors provide advisory services for: merger and acquisition support, including buy-side and sell-side representation; debt and equity capital formation; leveraged buyouts; ownership recapitalizations.

Highlights include:

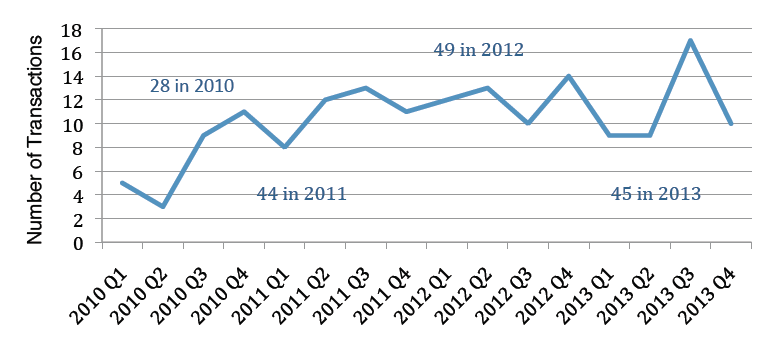

The level of deal activity was down just over 9% in 2013 vs. 2012 (45 deals in 2013 vs. 49 in 2012) back to about same level we saw in 2011. The difference was primarily in the decline of transactions involving distribution and service businesses (15 in 2013 vs. 19 in 2012).

There were about the same number of companies doing multiple acquisitions (10 in 2013 and 9 in 2012). The companies who have been the most active over the two years are:

- Dover Corp.

- DXP Enterprises

- Indutrade

There were 3 transactions with a value $1billion or greater in 2013 vs. 4 in in 2012.

The 2013 deals were:

- KKR acquiring Gardner Denver for $3.9 billion

- General Electric acquiring Lufkin Industries for $3.3 bill

- Atlas Copco Acquiring the Edwards Group for $1.6 billion

Other Large deals in 2012 were:

- AEA Investors acquiring Siemens Water Technologies business for $862 million

- DXP Enterprises acquiring B27 (Best PumpWorks, PumpWorks610, Integrated Flow Solutions) for $285 million

There was an uptick in transactions targeting the water and wastewater segment. The increase was mostly in companies that provide service including rental, services to buildings, or water treatment service providers.

The deal activity in Europe has remained fairly constant despite the ongoing economic issues in that part of the world.

The median EV/EBITDA transaction multiples for the FHI deals in our report for 2013 was 9.2 x vs median EV/EBITDA for PE buyout multiples thru Q3 2013 of 10.7x* which is up significantly from the PE buyout multiple in 2012 and 2011 of 8.5x*. Our speculation is that currently the demand for quality acquisitions significantly exceeds the supply. (*PitchBook 4Q 2013 Private Equity Breakdown page 8)

Read the full report here:

Comments