Authors: Maurizio Rovaglio, Vice President, Oil & Gas Technology and Alliances, Schneider Electric, and Jack Creamer, Market Segment Manager, Pumping Equipment–Industry Business, Schneider Electric

Most companies within the Oil & Gas industry have been able to withstand sharp drops in oil prices thanks in part to streamlining within their organizations and simplification of processes across their enterprises. The significant drop in oil prices— below US $40 per barrel at the end of 2015, down more than 60% from their high in the summer of 2014 (footnote #1)—reflects a combination of oversupply and weak global demand along with general global economic concerns.

How Oil & Gas executives respond to these changes and to other trends (e.g., growth in popularity of renewable energy) will determine both the short and long-term survival of their organizations. Most executives and their suppliers are beginning to think and act differently than they have in the past. They are reassessing the purpose and strategic direction of their companies and are finding new ways to make their organizations profitable.

Low prices are forcing powerful innovations in the way Oil & Gas is being developed and produced. Recent developments in the area of the Industrial Internet of Things (IIoT) are facilitating changes that can result in the reduction of unit costs of oil production and ultimately higher returns on capital employed. The profound technology changes that are just beginning to manifest themselves, will result in an Oil & Gas industry that will be stronger, leaner, and more durable.

The backbone of the transformative IIoT trend is the linkage of connectivity, cloud, and analytics technologies to simplify process automation. As pressure on oil prices continues, the demand for digitized upstream, midstream and downstream applications will grow. Opportunities to link multiple platforms operated remotely from a single onshore center or to deploy remote monitoring for onshore and offshore operations can dramatically reduce the need for physical on-site inspections. Consider, for example, how the use of drone technology to inspect pipelines or to discover new deposits in remote locations changes the equation.

Multiple flying drones called “aerial data collection bots” examine job sites during oil exploration. While performing their tasks, these drones generate large quantities of data in the form of high definition video. Legacy methods for performing this type of work involves manned helicopters with cameramen for shooting surveillance video. Self-piloted drones can photograph job sites 24 hours a day providing site managers an up-to-the-minute view of how their resources are deployed. A local edge computing site allows the drones to transmit the data in real time and receive instructions in a timely fashion.

Such a digital transformation framework empowers traditional refinery managers to re-invent their operations. By exploiting disruptive digital technologies, they can optimize CAPEX and/or OPEX while providing technologies, infrastructures and services that enable the transition towards a more sustainable business. Modernization of assets, volatility of market demand and energy efficiency are three disruptive forces that refineries will need to address in order to convert shifting business climates into opportunities.

The deployment of IIoT solutions translates into increased intelligence throughout the process workflow, more accurate and granular data collection and analytics, and higher levels of automated control and decision making. Deployment of these technologies can be viewed as disruptive to the traditional way of conducting business. In the end, however, IIoT approaches will help companies establish new benchmarks in efficiency (including energy efficiency), and productivity, while fostering collaboration.

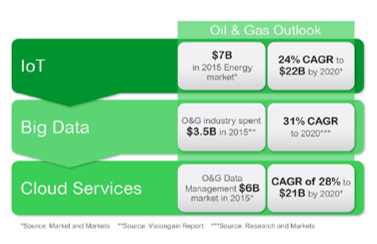

Industry Outlook

In 2015 the energy market spent $7 Billion on IoT solutions. Projected compound annual growth rate of this spending is expected to climb to $22 Billion in 2020 (footnote #2). McKinsey Global Institute research also projects a period of aggressive growth, estimating that the impact of the Internet of Things on the global economy might be as high as $6.2 trillion by 2025 (footnote #3).

Oil & Gas executives surveyed in June 2016 by Schneider Electric as part of its recurrent strategic research offered numerous perspectives regarding business growth, digital transformation and corporate culture transition. Most agreed that IIoT will be an important source of growth for them over the next several years—as will be the trends in wireless computing and big data. At the same time, the corporate leaders polled admitted that they lack a clear perspective on the concrete IIoT business opportunities given the breadth of applications being developed, and the fact that the trend is still nascent.

Below is a summary of some of the findings that resulted from the survey administered to the Oil & Gas executives:

- Cyber security was identified as the #1 potential obstacle when considering IIoT initiatives

- CAPEX savings were identified as the #1 motivator for initiating IIoT projects

- 62% of survey participants expressed a willingness to work with companies like Schneider Electric for the purpose of launching IIoT-related Software as a Service (SaaS) pilots

- 85% of survey participants indicated that they were looking to deploy SaaS solutions within next 1 to 3 years

These perspectives point to a need for Oil & Gas companies and their suppliers to adjust current business models. They will need to support these changes through the exploitation of new, more affordable IIoT technologies to deliver performance improvements.

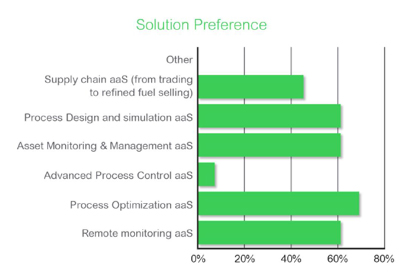

All participants also expressed a high degree of interest in expanding the use of “as a service” business models for both increasing productivity and lowering costs. The illustration below shows the solution preferences of the workshop participants.

Figure 2. Software as a Service (SaaS) solutions an apply themselves in multiple Oil & Gas value chain environments.

SaaS offerings are an outgrowth of the convergence of Information Technologies (IT) and Operational Technologies (OT). Flexibility and a “pay as you use” approach, which has made such offerings attractive across multiple industries, are now influencing cost control initiatives across Oil & Gas industry environments.

The SaaS business model presents both advantages and disadvantages for Oil & Gas company stakeholders.

Below are listed some of the more significant advantages:

- Time to deployment – SaaS software solutions can be implemented in a matter of weeks rather than months

- Fewer internal responsibilities – Cloud service providers are responsible for maintaining the software, upgrading the hardware and supplying enhancements through upgrades.

- Scalable and flexible – Cloud technology can be scaled up or down quickly to reflect changing customer requirements. Customers are only charged for what they use, without having to shoulder up-front deployment costs. Thus, start-up costs are lower than similar on-premises solutions. Software integration of cloud and existing home grown applications is also made easier.

- Anywhere access – Cloud technology only requires a browser and internet access to connect. This facilitates mobile access, remote work and collaborative sharing of information.

- Resilience – The IT infrastructure and the data generated is stored at the Cloud provider data center site. In the event of a disaster (i.e., should the data center go down for any reason), the data is backed up on a regular basis and can be easily accessed from another physical or virtual location.

The disadvantages of the SaaS model include the following:

- Security concerns – Access management and the privacy of sensitive information are still top of mind issues when placing company data into the hands of third parties. However, surveys have shown that these concerns are decreasing every year. Advancements in encryption techniques and other technological improvements are reducing the levels of concern so that cloud data is being considered at least as secure as traditional proprietary data (i.e., service providers are motivated to provide robust security in order to remain in business).

- Compliance – Individual countries and industries have differing regulations in respect to where data is stored. Businesses need to ensure compliance with these regulations when implementing SaaS solutions.

In order to execute against the changing business challenges of budgetary constraints, organizational barriers, cybersecurity concerns, poor process efficiency and high costs, the core IIoT-driven contributions supported by vendors like Schneider Electric include:

- Business process efficiency (higher productivity and profitability)

- High asset availability and performance (predictive and condition based maintenance)

- Risk mitigation and safety (embedding safety into product designs)

- Enablement of faster time-to-market (securing both centralized and edge applications)

- Sustainable growth (low CO2 emissions products and systems).

Today, the upstream represent the most active Oil & Gas domain on IIoT with more than 15 companies around the world delivering ‘as a service’ solutions to monitor remotely ESP and PCP spread in large geography and/or harsh territories. These cloud-based solutions provide value to users by significant saving on infrastructure, plus clear guidelines for maintenance, while optimizing production.

Footnotes

- Boston Commons High Tech Network, “World Oil Market Demand & Supply Trends”, July 2016

- Markets & Markets, “Internet of Things Technology Market by Hardware, Platform, Software Solutions, and Services, Application, and Geography – Forecast to 2022”, 2016

- Bauer, Harald, Patel, Mark, and Veira, Jan, McKinsey & Company, “The Internet of Things: Sizing up the opportunity”, December, 2014

This article is part of an eight-part series looking at how the Industrial Internet of Things (IIoT) concepts are transforming the Oil & Gas industry business model. For more information, please visit: goo.gl/4ohXN7.

About the Authors

Maurizio Rovaglio is Vice President of Oil & Gas Technology and Alliances at Schneider Electric in Italy. Mr. Rovagilo holds multiple patents and has authored over 100 technical articles published in international scientific journals, and has delivered presentations at multiple international conferences. Mr. Rovaglio has over 15 years’ experience in software sales, marketing, resource planning and project execution in the O&G domain across the world.

Jack Creamer is Schneider Electric Segment Marketing Manager – Pumping Equipment, based in the United States. Mr. Creamer has more that 30 years in the Electrical Industry, and has been involved for 10 years in the Pumping Industry. He is involved in key industry organizations such as the Hydraulic Institute and Submersible Wastewater Pump Association, where he holds both Committee Chair and Board level positions. In his time in the Pump industry, he has help Schneider create numerous solutions that both enhance pumping efficiency and address issues such as maintenance and downtime.