Supply chain, workforce, mergers and acquisitions, inflation, rising materials costs, Buy America and PFAS regulations, and advanced technologies like machine learning and artificial intelligence are topics on the minds of some of the industry’s most connected association leaders. We talked with experts from the Water and Wastewater Equipment Manufacturers Association (WWEMA), Electrical Apparatus Service Association (EASA), Fluid Sealing Association (FSA), Hydraulic Institute (HI) and the Vibration Institute to firmly place our fingers on the pulse of the industry as we enter 2023.

Here is the expert insight from the leaders of these highly-respected associations.

Industry Insight from WWEMA

For WWEMA members, the biggest challenges to continued business growth were noted in their responses to the 2022 WWEMA Market Indicators Survey. The overwhelming top challenge reported by nearly half (or 47%) of respondents was supply chain challenges. The second and third most significant challenges reported by 21% and 18% of respondents, respectively, were staffing and Buy America requirements.

The survey results were reinforced by insight provided by WWEMA Executive Director Vanessa M. Leiby, who said, “International and domestic supply chain challenges continue in the water and wastewater sector.”Tina Wojnar, WWEMA Program Manager-Policy & Member Services added, “With regard to supply chains, some WWEMA members have previously talked about “just in time” inventory, and now they are talking about “just in case” inventory. Wojnar then explained that “Companies are willing to incur the carrying cost to keep extraneous supply on hand so that they can be prepared for consumer demand and not take the risk of not being able to get what they need and causing delays for their customers. However, overall, the glass is definitely half full with lots of challenges and also many opportunities.”

“For our members who manufacturer very sophisticated, complicated technologies, they are often waiting on one little component that they need to complete the entire project,” Leiby explained. “This is causing many delays. Many areas are improving but people believe that will continue to be an issue moving forward.” The supply chain challenges are intertwined with inflation which continues to present an ongoing challenge for the water and wastewater industry and the overall economy more broadly.

“Several respondents wanted to check ‘all of the above’ because the challenges are so intertwined,” said Wojnar. “These challenges are very specific to our industry but there still seems to be an overall uneasiness about whether we are heading into a global recession. Things are looking very good for our sector, even with compliance challenges around funding. But there is still concern out there about the overall economy. So, overall things look promising but there is still a little bit of unease that’s difficult to quantify.” Leiby added that most WWEMA members report that 2022 was a good year and better than they expected.

“We have heard from our members—in particular the manufacturer’s reps—who have indicated that many bids that were estimated months ago are no longer valid or at the very least, much more costly due to inflation,” Leiby said. “Utilities are seeing sometimes double the cost of bids going out today for projects that were designed a couple of years ago. That’s caused a lot of different permeations in the industry. In some cases, utilities can find the additional money. However, in other cases they may be locked into SRF funding, which makes it difficult to go back and get more funding. Some utilities are delaying, scaling back, or not even moving forward with some projects.”

The engineering community will need to be cautious about outgoing bids and perhaps take the time to update those projections with a more realistic view of actual costs, Leiby advised. And that applies not only to products or components that are difficult to acquire, but it’s also about trucking and staffing and other issues that feed into the delays and costs.

Meanwhile, the Buy America requirements became effective on May 14, 2022, but with limited guidance from the Made in America office about how they will be interpreted for manufactured products. States and utilities are now scrambling to figure out the waivers put into place by EPA for Fiscal Year 2022 funding and how to move forward without definitive Federal direction, Leiby explained. “Fiscal 2022 money was minimally impacted by Buy America requirements due to National Planning Waivers,” she said. “When 2023 funding begins to flow, it will present an even bigger challenge as National Planning Waivers may no longer apply and project-specific waivers will be necessary.

“There are still enough projects in the pipeline and, at the end of the day, the work needs to get done,” she explained. “You can’t delay a plant upgrade forever. There is some stability in our market because of that. Most people feel confident that 2023 will be a positive year as far as workload. We just need to sort out the Buy America piece and ensure an efficient waiver process. And there needs to be realistic expectations on the part of the utilities, engineers, and contractors and a better sharing of the risk. It can’t all be pushed to the manufacturers.”

Another issue arising due to the challenges and complexity of the Buy America requirements is a reluctance from contractors to bid on projects. They are being more selective about the projects they want to work on, making the process less competitive and in some cases the result is a non-bid situation when not enough contractors bid on a public project. Meanwhile, the contractors and engineers are struggling with the same workforce challenges as everyone else.

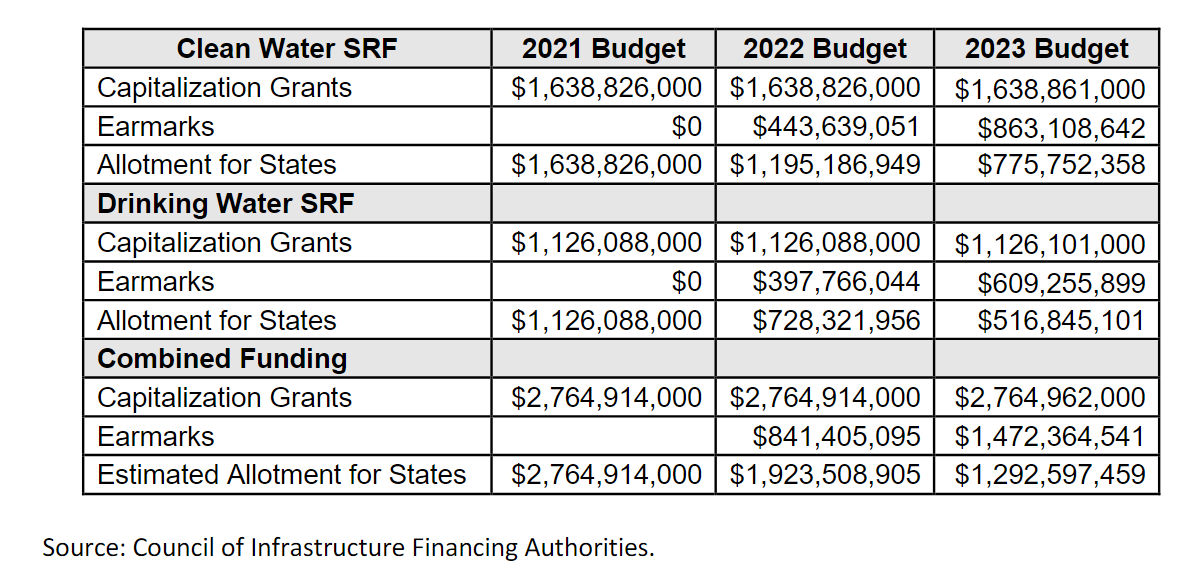

The actual amount of money available to the states for Fiscal Year 2023 will be significantly less in the general authorization process as well due to increasing Federal earmarks that are being taken off the top of SRF funding. And, of course, even as money flows and projects get underway, there are always more needs than there is funding, particularly with a significantly smaller pool of funding available for projects not included in the earmarks. “That is a practical boots-on-the-ground challenge at the state level,” Wojnar said. For that reason, there is concern in the water sector about the impact that will ultimately have on the viability of the SRF Program, Leiby added. According to the Council of Infrastructure Financing Authorities (CIFA) that represents the state SRF programs, the 2023 budget effectively cuts annual Federal funding for the SRFs by 47% compared to pre-Bipartisan Infrastructure Law (BIL) funding levels, specifically 47% for the Clean Water SRF and 46% for the Drinking Water SRF compared to 2021 funding levels. (See chart below.) WWEMA continues to support efforts by CIFA and others in the water sector to request that earmarks be funded outside of the SRF programs.

The 2022 WWEMA Market Indicators Survey also sheds light on how the water treatment technology industry has been performing and what the outlook for the next review period might hold. Overall, the performance of the water treatment technology market was strong in the September 2021 –August 2022 period with only one of the eight water market categories not showing approximately 80% or greater growth. The lowest-performing survey indicator in the survey was international sales, which had only 28% of companies reporting growth.

The level of positive growth in this year’s survey outpaced the performance reported in the 2021 WWEMA Market Indicators Survey when only 26% of companies reported growth in the 7.5-10% range. The outlook for domestic sales remains very positive with an equivalent 88% of respondents expecting continued positive growth in the September 2022 –August 2023 period. Therefore, the optimism reported in the survey seems justified in light of the historic $55 billion investment from the BILforfunding for water and wastewater projects. Access to this funding will not be without its industry-specific challenges including allocation delays and Buy America compliance challenges as well as overall economic challenges including inflation and securing a qualified workforce to perform the work.

Water and Wastewater Equipment Manufacturers Association (WWEMA) is a non-profit trade association formed in 1908. WWEMA represents many of the most prominent and influential water and wastewater technology manufacturers that work together to shape the future of our industry. Learn more about WWEMA and Association membership at www.wwema.org/membership.

Industry Insight from EASA

For EASA, some of the key industry trends we should look for in 2023 include an upward trend with regard to mergers and acquisitions.

“This isn’t a new trend,” explained Lindy Raynes, CAE, President & CEO. “But an ongoing challenge is the need to attract employees to the industry. We recognize this is true for all skilled trades. As an international organization, we see those same challenges in other countries, as well.”

Another recurring trend in the electrical motors sector is supply chain challenges.

“There currently is a trend for more repair rather than replace as supply chain issues continue to impact new motor sales (and likely pump sales as well),” Raynes said. “We see that continuing in 2023.”

Like many other industries, EASA members are reporting workforce, particularly with regard to attracting and recruiting employees, as a challenge from 2022 that will continue in 2023.

However, overall, Raynes said that EASA members are remaining positive as we enter 2023.

“For the most part, our members have been flat-out busy for the last 12-18 months,” Raynes said. “Even with the challenging economy, inflation pressures, and talk of a global recession, any member I’ve spoken with anticipates 2023 to be busy.”

Technology advancements will continue in 2023, as well, according to Raynes.

“Perhaps the ever-increasing speed of advancements in technology (e.g., remote condition monitoring, internet of things, artificial intelligence, etc.)is the challenge,” Raynes explained. “EASA has a volunteer committee on emerging technologies to help members stay abreast of those developments and their impact.”

EASA is an international trade organization of more than 1,700 electromechanical sales and service firms in early 70 countries. EASA supports companies involved in the service and sale of electric motors, pumps, drives, controls, gearboxes and other rotating machinery. Join EASA and build relationships with your peers around the world, gain access to state-of-the-art resources and so much more. https://easa.com/join

Industry Insight from the Vibration Institute

According to Janine Komornick, Vibration Institute’s Manager of Operations, one trend that we may see in the next few years is an increasing emphasis on automation and the use of technology to improve efficiency and productivity.

“This could involve the use of artificial intelligence, machine learning, and other advanced technologies in various industries,” Komornick explained. “Another trend that we may see is a continued focus on sustainability and environmental concerns. Many companies are already taking steps to reduce their carbon footprint and minimize their impact on the environment, and this trend is likely to continue in the coming years.”

Proper equipment maintenance eliminates energy waste and lengthens machinery life, benefitting the environment and the bottom line, Komornick explained. “There may also be a continued trend toward remote work and the use of digital technologies to facilitate communication and collaboration among teams.”

The COVID-19 pandemic has accelerated this trend, and it is likely to continue even after the pandemic subsides, she elaborated.

“The challenges we face are related to industry trends, and not necessarily unique to the VI,” Komornick said. “They include attracting the next generation of vibration analysts, growing our digital presence through online learning, our enhanced digital library, and our smartphone app development.”

In terms of a general industry outlook entering 2023, Komornick explained that there is a demand for certification, and certification is growing in popularity in the following industries: Electric Power Generation, Oil and Gas, Pulp and Paper, Mining, Chemical Processing, and Hospitals.

“In an increasingly competitive marketplace, employers and clients seek the most qualified and knowledgeable professionals,” she said. “Accredited certification validates employees’ skills and knowledge that ultimately results in better service, support, and customer satisfaction grounded in safe and effective practices.”

In terms of certification, accreditation is important. The Vibration Institute’s Vibration Analyst Certification Program is an ANAB (ANSI National Accreditation Board) Accredited Personnel Certification Program. When applying for a job, recruiters and hiring managers may want to verify that certification was obtained from a program that is accredited.

“One of the primary benefits of accreditation is that it helps to ensure the quality of the program,” Komornick explained. “It also helps to enhance the credibility and value of the certification earned. Employers, commercial insurers, and other stakeholders often consider accredited programs to be more credible and trustworthy than non-accredited programs, and they may be more likely to recognize and value the certification.”

Vibration Institute’s mission is to disseminate practical information on evaluating the behavior and condition of machinery without commercial interest. The Institute offers a variety of programs, including education, training, certification, and opportunities for technical knowledge exchange. Its members share information, procedures, and cutting-edge data through formal training, networking, meetings, and publications. If you would like to join our network of esteemed colleagues, improve your skills, and expand your education in the study of machine vibration, contact us directly, and get started as a member. information@vi-institute.org

Industry Insight from HI

Throughout the past several years, the biggest challenge for Hydraulic Institute members has been focused around the workforce—attracting and retaining talented and skilled workers, according to HI Executive Director Michael Michaud.

“The workforce challenges have begun to shape how HI thinks about what we are doing and how we can support our members,” Michaud explained. “More than 100 years ago we began to create standards, and we are excited that we recently published our newest standards, which defines workforce knowledge for the industry.”

The workforce standards are free and available to anyone on the HI website.

“This is the standard of what you need to know to be a practitioner in the pump industry,” Michaud said. “It’s from a manufacturer’s perspective, as well as an end user’s perspective. The goal is to establish a level playing field. That’s the first step, but we also continue to provide top-level training.”

Not only do these standards help with training, but they also help to establish hiring criteria for specific jobs within the industry.

“By next year, we hope to provide a Level One exam that organizations can use as an onboarding tool to help streamline the talent and knowledge required for specific jobs in the pump industry,” Michaud said. “We also launched a career center with helpful tools like pump industry job descriptions that will help in the hiring process.”

Part of the challenge involves raising the awareness within the general community about the impact of pumps so that new talent will be interested in pump-related job opportunities.

To address this challenge, HI launched an awareness campaign called “A World Without Pumps” to complement the workforce standards and to help young talent understand the importance of the industry.

“If you are a young person looking for a good career and you want to make a difference, we have an industry that makes a huge difference,” Michaud said. “Take a look at all the things we take for granted—we wouldn’t have clean water, or electricity, or air conditioning, or power, or processed food, or so many other necessities without pumps. We hope that some of these materials and programs will help to further differentiate us as an industry that young talent can get great jobs that make a difference.”

Other issues keeping HI members up at night include supply chain issues and Buy America regulations.

“HI has a great relationship with the EPA so we continue to push for waivers and other things that will help to support our members,” he said. “The most important thing from our perspective is to ensure that these projects happen, particularly with wastewater infrastructure projects that are so badly needed.”

Michaud said that HI is extending energy efficiency requirements to circulators, while also seeing more activity in energy-efficient agricultural and irrigation systems.

“Energy efficiency is becoming an even bigger buzzword, not just for the manufacturers, but also for the end users,” Michaud said. “People are looking to find system savings and our Pump System Assessment Professional credential will be important to companies looking to hire qualified people to assess their systems.”

Overall, the HI outlook for 2023 is strong.

“There are a few clouds on the horizon, but overall, I think the positive tailwinds will push us through,” Michaud said. “We still need to do the work, but that’s what we are here to do.”

Founded in 1917, the Hydraulic Institute (HI) is the largest association of pump manufacturers in North America. As the global authority on pumps and pump systems, HI develops standards and technical resources including application guidebooks, online tools, and calculators. https://www.pumps.org/who-we-are/

Industry Insight from The Fluid Sealing Association

It was a strong year for the fluid sealing industry, according to FSA’s President, Thom Jessup.

“Our company and others within the FSA experienced a lot of growth,” Jessup said. “We were very busy. The industry challenges came from getting product in the door from overseas. Prices have increased across the board, which has been a challenge, but companies are doing what they can to trim that.”

The Fluid Sealing Association has been working with government officials on PFAS legislation. There are more than 6,000 different chemicals that are being placed under one umbrella, Jessup explained. “We are trying to increase the awareness that the products that we use in our industry don’t have those harmful chemicals for a long period of time,” he said.

“We want to educate the public on the benefits of those products that we use and help them to understand that they don’t hurt the atmosphere or the water. That’s a big challenge for the FSA.

”Looking ahead to 2023, the Fluid Sealing Association will continue monitoring PFAS legislation and homing in on the FE regulations and the benefits that will come from the IRA.

“From an aftermarket perspective, we shouldn’t see much of a slowdown,” Jessup said. “From an OEM perspective, the industry may be a bit stagnant in 2023, or maybe even experience a slight slowdown. This is typical for our industry. Early in the year, you’ll see OEMs put the brakes on purchases and keep their inventories low and wait to see how things pan out. In the meantime, the aftermarket keeps going and actually gets a little stronger. People aren’t buying new things. Instead, they are repairing old things. In our industry, we are both OEM and aftermarket, and that helps to balance things out.

”The association has had discussions about Seal Team 4.5, spearheaded by FSA former President Rob Coffee. The idea is to have people on the ground talking about the Fluid Sealing Association, as a whole.

With regard to fugitive emissions, the industry continues to move forward, even without government intervention. FSA companies are refining their fugitive emission products to make them better and more efficient.

Attracting and retaining talent is also an issue in the fluid sealing industry.

“It’s an expensive problem, not only the cost of salaries, but the cost of onboarding new people,” Jessup explained. “Some accommodations are being made for people who want some remote-working flexibility. Fortunately, I see the issues of Covid behind us. I think tradeshows will continue to ramp up, although some companies saw the benefits of saving those costs and instead began promoting virtual events.”

Overall, the outlook for 2023 looks good for FSA members.

“I think it will be a positive year for fluid sealing companies,” Jessup predicted. “There will be some growth. We will continue to move forward with the effort to reduce power consumption and keep bad things out of the water and the air. Fluid Sealing Association companies will continue to do what they can for the environment.”Founded in 1933, the FLUID SEALING ASSOCIATION® (FSA) is an international trade association. Member companies are involved in the production and marketing of a wide range of fluid sealing devices primarily targeted to the industrial market.

Fluid Sealing Association membership includes a number of companies in Europe and Central and South America, but is most heavily concentrated in North America. Fluid Sealing Association members account for a majority of the manufacturing capacity for fluid sealing and containment devices in the Americas market. https://www.fluidsealing.com/about-us/

Michelle Segrest is president of Navigate Content, Inc., and is the author of three books about Modern Manufacturing.