Achieving production efficiency and cost optimization are the two pivotal factors driving the adoption of valve monitoring solutions.

The dawn of Industrial Internet of Things (IIoT) is gradually transforming asset operations by unleashing new capabilities that help in achieving maximum utilization, improve productivity and operational efficiency. The integration of IoT, that includes connectivity and intelligence, is influencing even the valves industry where manufacturers are actively exploring the revolutionary technology (IoT) to assist end-users to reduce the complexity involved in its maintenance and assure uninterrupted production operations. In the present business environment with constantly changing customer needs, volatile economic conditions, mounting cost of production and increasing price wars, it is imperative for end-user industries to have greater control over their production processes and redefine their maintenance approach in order to prevent unnecessary asset downtime.

For a deeper understanding on the end-users and OEMs approach towards the emergence of IIoT and its role in easing market concerns, Frost & Sullivan conducted an extensive survey in the beginning of 2018.

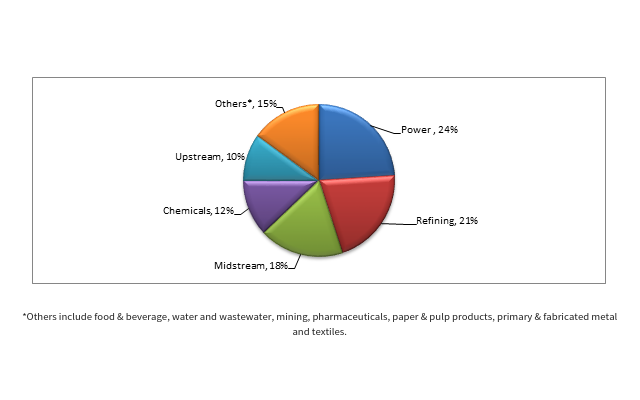

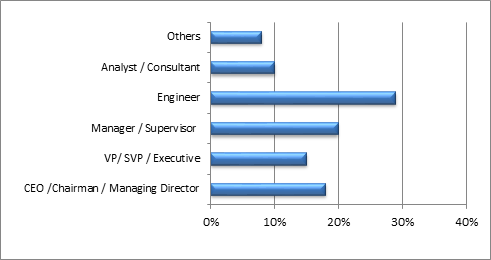

Nearly 200 market participants across the globe shared their viewpoints on present challenges, emerging trends, role of IoT and future roadmap of integrating these revolutionary technologies to their manufacturing processes. Overall the interviewed participants had optimistic outlook on the potential of IoT to transform asset health and plant maintenance approach. In this survey, as provided in the illustration below, several executives, plant engineers and maintenance managers from the process industries expressed keen interest on leveraging IoT based technologies.

Figure 2 provides an overview on the list of interviewees involved in the survey. This includes the titles of these interviewees ranged from CEO’s and Chairmen to Maintenance Managers & Engineers of leading organizations.

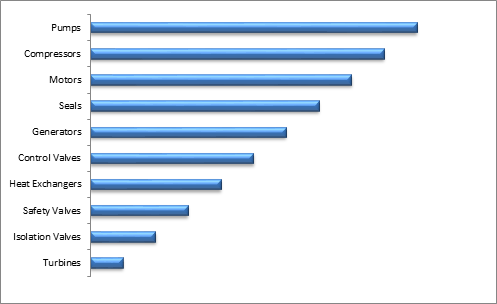

The entire valves industry has been witnessing tide of fluctuations due to the turbulent investment climate in the oil and gas industry that has constricted its capital spend thereby lowering the demand for valves. However the industry is at the phase of redefining their investment strategy towards minimizing operational expenditure (OPEX), maximize asset utilization and improve production throughput. When quizzed the executives, managers and engineers, curtailing expenditure towards plant operations and maintenance was accentuated as the main strategic goal in the short term. They have also shared the top assets requiring immediate attention and serving as the root cause for equipment failure, production delay and unplanned shutdown of plants. As depicted in figure 3, large portion of maintenance cost is incurred by pumps followed by compressors, motors, seals, generators and control valves.

In this survey when the market participants were questioned about the root-cause for valve failures, corrosion was highlighted as the chief factor that arises due to the valve exposure to extreme temperature conditions, frequent contact and reaction with various fluids and slurry that deplete valve performance. In addition to this few other factors such as fugitive emission, stem packing failure, stem leakages and seat erosion contribute towards the failure of the valves. They had further expressed the cost variations involved throughout the valve lifecycle. For instance with control valves the maintenance cost which includes spare parts is higher as compared to the purchase and installation cost. However in the case of safety and isolation valves the purchasing and commissioning cost is threefold higher than maintenance cost.

To address these pressing requirements of the end-users, valve manufacturers have been constantly exploring new technologies that enable real-time monitoring of the value performance. The introduction of these functionalities helps to measure failure, frequency, evolution of temperature, corrosion and leakages of valves. This is expected to gain traction particularly for valves that are used in critical plant operations. Amongst the various types of valves, it is observed that valve manufacturers are gradually expanding the smart monitoring capabilities to their product line offering critical and control valves. However in the case of isolation valves there exists a certain degree of technology gap with limited integration of intelligent sensors, cloud, analytics, machine learning and industrial mobility.

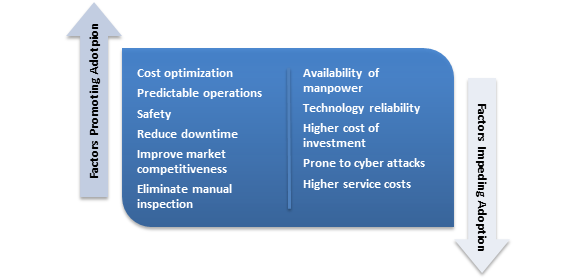

In the below chart, interviewees have expressed the main factors that are driving them to invest in IoT monitoring solutions. The foremost reason that makes IoT monitoring an attractive solution especially in the process industries is its potential to optimize costs. Moreover to prevent the risk of costly failures access to reliable and precise asset data encourages plant engineers to proactively plan maintenance, optimize resource utilization and promote safety. However certain industries with conservative mindset prefer to perform manual inspection as they have ample resources to execute these tasks and are relatively cheaper as compared to the investment involved for IoT monitoring solutions.

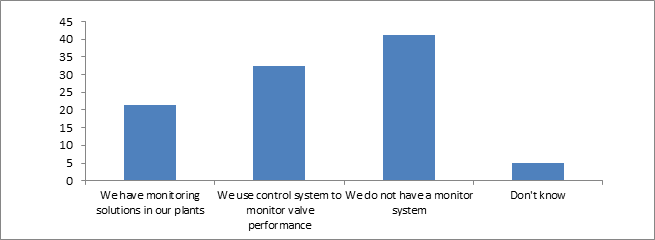

Though majority of the interviewed participants, accounting to nearly 42% (refer to figure 5), currently do not have any valve monitoring solutions in their existing plants, this mindset is anticipated to gradually change in the long term as vast number of end-user industries are rigorously working towards cutting down their OPEX and discover new revenue streams. In fact, about 23% of the surveyed companies already have valve monitoring solutions.

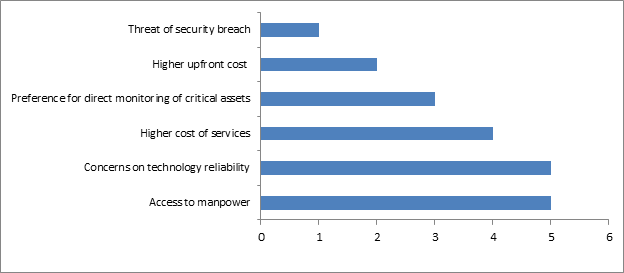

When questioned the same set of market participants on the main factors restricting them from investing in valves monitoring solutions, lack of reliability and preference to depend on skilled workers to perform manual inspection was quoted as the two main reasons. The below chart provides the ranking of the top reasons in terms of importance for not investing in valves monitoring solutions.

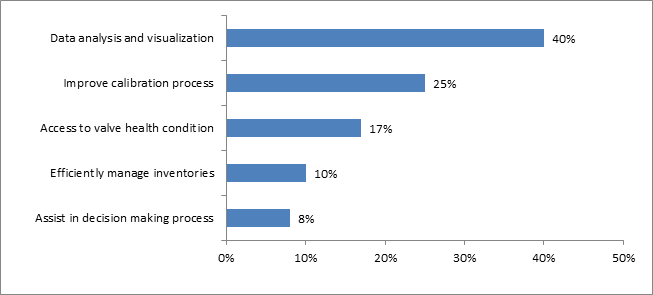

A notable aspect is that several participants have expressed their expectation from IoT monitoring solutions and factors that are likely to drive its adoption. This is highlighted in the below chart (Figure 7) where end-users are willing to experiment and invest particularly for the critical valves that require timely replacement of spare parts, expedite the calibration process and gain insights on the valve health condition that assists in the management’s strategic decision-making process and draw actionable insights.

In addition to these expectations, end-users have also expressed the need for the IoT monitoring solution to expand its capabilities with respect to the method of measurement and evaluation of parameters used to determine the health condition of the assets. Apart from analyzing patterns in the pressure, temperature, flow and vibration of the valve, to determine the need for maintenance and service there are certain critical areas that require continuous monitoring. For instance the existing IoT monitoring solutions lack the ability to perform in-situ and signature analysis, that are indispensable for the oil and gas and chemical processing industries.

Despite the existence of mixed mindset towards the need for IoT based valve monitoring solutions, the evolution of business models that requires mass customization, shorter time-to-market, and development of blockbuster products and deliver cost-effective products, the role of asset data forms the fulcrum of company’s growth strategy in this competitive environment. These dramatic shifts require valve manufacturers to adapt to these dynamic market conditions and redefine their product offering. This paves way to embrace new business models transitioning towards service based offering such as valves-as-a-service. Several tier-1 and niche valve manufacturers are proactively integrating IoT technologies to their valve’s portfolio which includes intelligent sensors, connectivity platforms, cloud infrastructure, data analytics, cognitive computing and industrial mobility that helps to address the unmet needs of the end-users. The ability of valve manufacturer to deliver end-to-end support that eases valve maintenance and servicing process, enables to extends the product’s lifecycle and importantly ensure continued product operations with no disruption is the need of the hour. Valve manufacturers building on their condition monitoring capabilities with flexible cost options is likely to have higher demand in the short term as it matches with their current budget spend that is restricted to less than 2% of the total asset value. However in the long run, as end-users move towards digital plants, the growth prospects of valve monitoring services featuring advanced services assimilating IoT based technologies is likely to experience an uptake across industries.

Overall, IoT monitoring services for valves has constricted acceptance at present due to limited visibility on benefits achieved and its return on investment (ROI). Regardless of the pessimistic perspective towards these solutions, it is expected to change in the forthcoming years as IoT plays a pivotal role in fulfilling end-users strategic goals.