Frost & Sullivan Research Analyst Shilpa M R

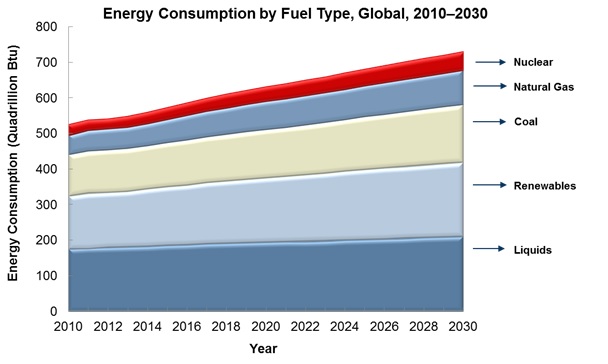

From a power generation standpoint, it has become evident that the consumption patterns of all modern fuels is set to witness a constant rise over the next 25 years despite a slight decline of 0.2 percent in the consumption of coal. Global installed power generation capacity is forecast to rise from 6,292 GW in 2015 to 9,417 GW in 2030, with electricity generation rising from 24,240 TWh to 33,560 TWh during the same period. To meet the rising demand for electrical energy, electricity generation will rise by 38.5 percent between 2017 and 2030. Installed capacity, meanwhile, will grow by 49.7 percent over the same period.

As a result of the phenomenal economic growth in Asia, the demand for energy in the region is rapidly on the rise. It currently accounts for approximately 30 percent of the global energy demand. All fuel sources, apart from oil, will expand, but coal will remain the dominant fuel source throughout the forecast period, accounting for 24.9 percent of the installed capacity and nearly 32.5 percent of generation in 2030. Gas, however, will nearly reach the capacity of coal by 2030.

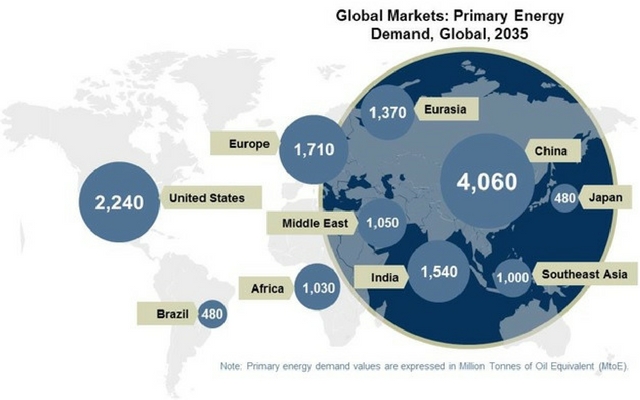

In the figure above, it is evident that the primary demand for energy is stemming predominantly from the Asia-Pacific region with China leading the way with a forecasted demand of 4,060 MtoE and India demanding 1,540 MtoE of energy. For India and China, coal is the primary fuel used for power generation. Demand is driven by the high economic growth and the rising demand for power. On-going coal shortages in India curtail its potential. However, in Russia, there is an increasing need to replace some old plants. Russia is keen to diversify from gas-based power generation to free up gas for exports.

In the United States, low gas prices are hurting the coal market. Coal’s share of electricity generated in 2012 was the lowest in the past 40 years (at 37 percent), but it has since recovered from these lows. Older coal plants are shutting down due to rules set by the Environmental Protection Agency, with 50-70 GW of the capacity slated to retire over the next decade.

The power sector in Europe (with an estimated demand of 1,710 MtoE by 2035), is said to be driven primarily by the recent de-commissioning of ageing capacity of coal plants. In recent times though, gas and renewables are favoured in Western Europe as coal plants are not considered viable due to public opposition. However, Poland, Serbia, and Turkey are important future markets for coal plants.

From the Middle East point of view, coal has a very limited role in power generation and its future prospects in the region are modest. Dubai aims to complete a 1,200 MW modern coal plant by 2020. Oman also plans to develop a 1,000 MW coal plant. Also, in South Africa, massive coal expansions are underway, mainly through two 4,800 MW supercritical coal plants at Medupi and Kusile with the World Bank’s funding. Coal plants are also being added in Zambia and Botswana to address capacity shortages.

Whilst gas-fired capacity will see a substantial net increase in most regions of the world, overall coal-fired capacities will only see major growth in emerging regions, specifically in China and India, though significant expansion is also envisaged for other developing Asian countries. Coal-based capacity will decline substantially in both Europe and North America as new emission legislation come into operation.

Whilst gas-fired capacity will see a substantial net increase in most regions of the world, overall coal-fired capacities will only see major growth in emerging regions, specifically in China and India, though significant expansion is also envisaged for other developing Asian countries. Coal-based capacity will decline substantially in both Europe and North America as new emission legislation come into operation.

Gas-fired additions are driven by the need for cleaner and more flexible generating systems and by the growing gas output around the world. Capacity expansion during the current decade (2010–2020) is driven by North America and the Middle East, adding 102 GW and 96 GW, respectively. China will be the leading region in the following decade.

Over the coming five years (2017–2022), hydro power and nuclear will show the greatest growth. Substantial expansion of hydro energy is underway in regions such as Africa and China. Nuclear power growth, meanwhile, is driven by China, Russia and other Asian nations as well the gradual recovery of Japanese production. Gas expansion will actually accelerate post-2020 as it increasingly becomes the thermal fuel of choice for new-build projects and cost and availability of the fuel improve. Renewable energy production growth rates will be very impressive, with blistering growth expected from solar PV in particular, where dramatic cost reductions are making the technology competitive with established generating sources across a rising number of countries.

Amid a rising penetration of renewable energy sources, it is worth noting that fossil fuels will remain dominant in electricity supply well beyond 2030. They will still account for 51.7% of the world’s installed generating capacity and 56.1percent of power production by 2030, though this is down from 57.9 percent in the previous edition, due to an upgrading of the renewables forecast and consequently somewhat reduced requirements for conventional thermal energy.

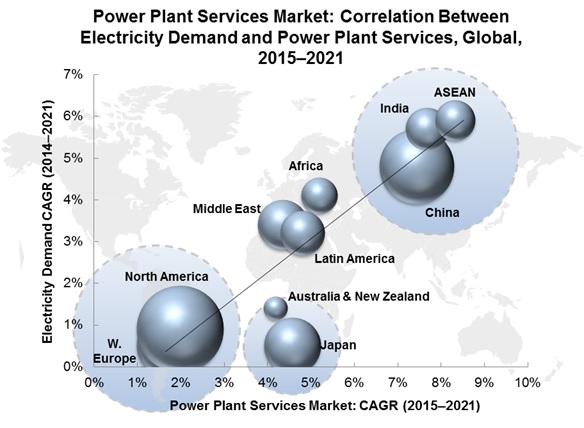

The power generation services market is, however, forecast to grow somewhat more rapidly. The global correlation, comparing forecast growth for both indicators, is 1.52. While the services market is slated to grow by 4.1percent from 2015 to 2021, global electricity demand growth will be 2.6 percent. As the electricity demand rises, new generating capacities are added to the system, which in turn requires servicing and this trend is driving up the market for power plant services market.

The power generation services market is, however, forecast to grow somewhat more rapidly. The global correlation, comparing forecast growth for both indicators, is 1.52. While the services market is slated to grow by 4.1percent from 2015 to 2021, global electricity demand growth will be 2.6 percent. As the electricity demand rises, new generating capacities are added to the system, which in turn requires servicing and this trend is driving up the market for power plant services market.

With gas being forecasted to increasingly replace coal in all OECD countries, pump manufacturers are bound to benefit tremendously from the power sector in 2017. The renewable power industry is expected to purchase pumps close to worth $1 billion until 2017, of which centrifugal pumps are to make up almost 67 percent of the sales while diaphragm, rotary, and reciprocating pumps are expected to make up 12 percent, 12 percent, and 9 percent, respectively. Sales of pumps in the renewable power industry are expected chiefly from Asia due to the quantity of new renewable power generation installations. In the United States, most new capacity additions are likely to be gas-fired.

The Last Word

- Progress in the penetration of carbon-free power generation will accelerate substantially over the next few years, as the global share reaches 38.1percent by 2020. Key contributors to this are: large-scale expansion of renewables in Asia (driven by China and India in particular), the expected recovery of nuclear generation in Japan and a slower expansion of coal-fired generation in China, with coal plant closures in Europe also gaining momentum.

- The decade after 2020 will be marked by a continued expansion of renewable energy and—in the Eastern Hemisphere at least—nuclear power. Carbon-free electricity’s share is slated to reach 43.9 percent in 2030. The growth impetus in Asia will gradually shift from China to India, and carbon-free power will also start to penetrate the Middle East much more rapidly.

- Europe will maintain its global leadership in deployment of renewables, as less than one-third of the EU’s power will come from fossil fuels in 2030.

- From a pumps point of view, targeting commercial applications will be a strong growth option, as the residential market steadily matures. The commercial sector represents immense opportunities for suppliers that can provide high-capacity pumps that are needed for this market segment.

About Frost & Sullivan

Frost & Sullivan, the Growth Partnership Company, works in collaboration with clients to leverage visionary innovation that addresses the global challenges and related growth opportunities that will make or break today’s market participants. For more than 50 years, we have been developing growth strategies for the global 1000, emerging businesses, the public sector and the investment community. Contact us: Start the discussion