It’s widely accepted that pump motors account for an estimated 15 percent of global electric energy consumption. However, with more than 35 percent of centrifugal pumps undergoing stricter energy efficiency regulations by 2017, this percentage is likely to decline. Efficient technology design is now the name of the game, and centrifugal pump suppliers now face a flood of new competition, according to a recently released report, “The World Market for Centrifugal Pumps”, from IMS Research, recently acquired by IHS Inc. (NYSE:IHS).

“Customers are beginning to realize the benefits of a life-cycle approach when purchasing centrifugal pumps,” said Preston Reine, pumps analyst for IHS. “The initial purchase is normally only 15 percent of the unit’s lifetime cost, so demand for more energy efficient and longer-lasting pumps is on an increasingly upward trend.”

Technological advances have led to more electrical components being used in pumps and more complex pump designs, substantially increasing the price of these units. As a direct result, companies that can adapt to the upcoming new requirements are likely to enjoy larger revenues as efficiency standards and customer focus on life-cycle costs remain the key drivers for this market. Because of this, suppliers need to offer more than attractive selling prices and installation costs in order to remain competitive.

The global pump market is a highly fragmented and mature market, so change often occurs slowly. However, certain sectors react quite differently to innovation than others. An example of this can be seen when comparing the pump markets in heavier industries with those of commercial and residential industries.

The new IHS report, entitled “The World Market for Centrifugal Pumps”, breaks down the centrifugal pump market into three separate classes of industry sectors: non-industrial, general, and heavy industries. Almost two-thirds of centrifugal pumps shipped in 2012 were sold into non-industrial applications, which make these pumps the most likely target of efficiency requirements. These are the most common and typically the lowest-cost pumps, so the focus on standards compliance will largely be in these applications.

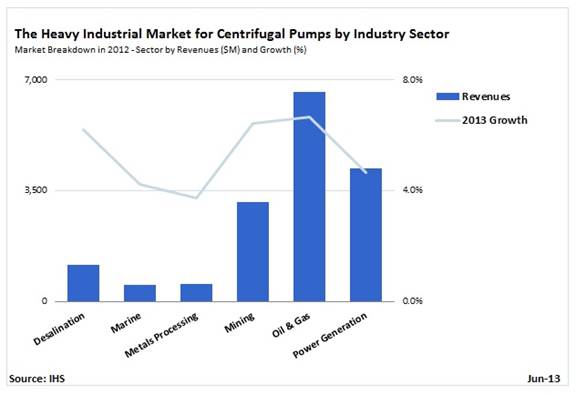

The heavy industry sectors only accounted for 5 percent of centrifugal pump unit shipments in 2012. That, along with the more conservative nature of these sectors, has stalled efforts by national governments to apply similar efficiency requirements within these verticals.

Currently, the Eurozone is far ahead of any other region in terms of pump regulations. Regulations there have already been implemented for circulators and clean-water centrifugal pumps, sparking intent by other national governments to follow suit. China and South Korea have previously established a graded structure for labeling clean water pumps in 2005 and again in 2010, though suppliers reported very loose enforcement of those requirements. Now that the Eurozone is much farther ahead than other nations, the US, Brazil, and several Asia Pacific nations, especially China are now constructing the framework for standards that are expected to reflect a similar design to that of Europe.

Suppliers expect major changes to the structure of the market. Several manufacturers noted that some pump companies in Europe were either unaware of the regulation changes or technically incapable of complying. Smaller companies lacking the capability to make regulated changes are at risk of going out of business, and merger and acquisition activity is expected to increase over the next several years as a result.

With all the upcoming changes in this market, the average selling price of non-industrial centrifugal pumps is forecast to expand at a compound annual growth rate (CAGR) of more than 3 percent from 2012 to 2017. This price growth, coupled with a steady rebound of the global economy throughout the forecast period, will be a boon for the centrifugal pump manufacturers that are able to remain competitive.

Published in May, “The World Market for Centrifugal Pumps – 2013 Edition” provides an accurate portrayal of how the market for centrifugal pumps is forecast to perform through 2017 and offers insight into which regions and product categories will experience the fastest growth in the future.