Stormwater management in the U.S. is growing rapidly as an area of critical concern for municipalities, transportation departments, and property owners. The increasing frequency and severity of climate events responsible for US$156.8 billion in damages since 2000, are driving the needed deployment of hardware, innovative solutions, and capital for U.S. stormwater infrastructure.

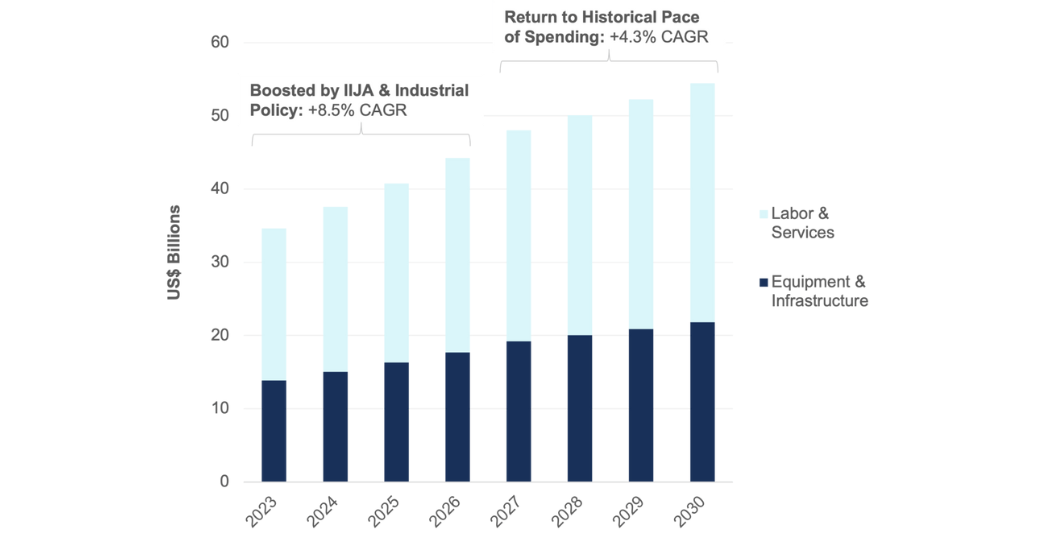

According to Bluefield Research’s report, “U.S. Stormwater Infrastructure Market: Key Drivers, Competitive Shifts & Investment Outlook, 2024–2030,” capital expenditures (CAPEX) for stormwater management in the U.S. are projected to grow from US$34.6 billion to US$54.5 billion between 2023 and 2030. This represents a 6.7% compound annual growth rate. In the near-term this growth will be partly driven by federal infrastructure investment, including the Infrastructure Investment and Jobs Act.

“Stormwater infrastructure assets, which were designed to handle historical levels of precipitation, are increasingly insufficient to withstand the frequency and severity of today’s storms,” says Eric Bindler, Senior Director, Bluefield Research. And climate events are on the rise. Since 2020, the U.S. has experienced an average of 22 ‘billion-dollar disasters’—or weather events causing at least US$1 billion in damages—each year, compared to an annual average of only three events per year in the 1980s, according to the National Oceanic and Atmospheric Administration.

When compared to investment in the drinking water and wastewater sectors, stormwater management and infrastructure has been largely overlooked and underfunded. Stormwater currently receives approximately 7.5% of total water sector funding across key sources, according to Bluefield’s analysis. This disparity stems from stormwater’s complex, multijurisdictional patchwork of entities that share responsibility for stormwater—from utilities and public works departments to state transportation agencies—regional flood control districts, and private property owners. “Without a clear champion and dedicated funding channels, both large and small communities are at greater risk of stormwater management issues, including flooding,” says Bindler.

Exhibit: Top-Line U.S. Stormwater CAPEX Forecast by Spend Type, 2023–2030

Note: Values expressed in 2023 US$

Note: Values expressed in 2023 US$

Source: Bluefield Research

The stormwater market outlook is shaped by the recent surge in public and private construction. New roadways, commercial and industrial facilities, and residential subdivisions are increasingly designed with stormwater infrastructure included, driving a surge of greenfield market activity for vendors and solutions providers. However, the rapid construction boom in Sunbelt states including Arizona, Florida, Georgia, and Texas, is also contributing to the expansion of impervious surfaces (i.e., concrete, asphalt, and other surfaces that do not allow for water to seep into the ground), further exacerbating stormwater runoff and water pollution.

According to data from the United States Geological Survey, approximately 0.5% of the United States’ 3.5 million square miles of total land area are covered by parking lots alone—this is more land area than the state of Maryland. These impervious surfaces exacerbate both flooding and water pollution issues as stormwater runoff has nowhere else to go. Nearly one-third of the nation’s 470,000 assessed water bodies are classified as impaired, with stormwater runoff—from urban areas, roadways, and agricultural operations—a leading contributor.

The underlying solution for stormwater management, to date, has been physical infrastructure (e.g., pipes, pumps, catch basins). Hardware and equipment account for roughly 40% of total stormwater CAPEX forecasts through 2030, scaling from US$13.8 billion in 2023 to US$21.8 billion in 2030. Labor and services (e.g., engineering, design, construction) make up the remaining 60% of stormwater CAPEX, according to Bluefield’s analysis.

Bluefield’s forecast methodology frames the market into three primary end-user segments: municipal, transportation, and commercial & industrial (C&I). The C&I segment currently represents 57% of the total addressable market. “Private firms, driven by changing state and local regulations, are deploying decentralized infrastructure to offset onsite impacts from their respective office buildings, parking lots, and manufacturing facilities,” says Bindler. In particular, manufactured stormwater storage and treatment systems (e.g. on-site storage chambers, hydrodynamic separators) are attracting investment as municipal governments and C&I facilities are compelled to address stormwater management.

“Given the increasing scale of the sector and related challenges, a growing roster of incumbents and emerging solutions providers are carving out positions to address stormwater management. The solutions range from traditional ‘gray’ infrastructure—drains, pumps, catch basins, chambers, and decentralized treatment systems—to newer digital platforms and alternative ‘green infrastructure’ solutions such as rain gardens and permeable pavement,” says Bindler.

At the leading edge of the market are established infrastructure and equipment providers, such as Advanced Drainage Systems, Oldcastle, Northwest Pipe, and IPEX. These players are pursuing strategic M&A and eyeing new market opportunities (e.g., agriculture, digital) to drive revenue growth and expand geographic footprints.

Other companies with alternative approaches to traditional stormwater management, include players like TrueGrid, MKB Innovation, and Invisible Structures who are making strides in the green infrastructure market. OptiRTC, 2NDNATURE, Bentley Systems, and Autodesk are approaching the stormwater management market through a digital lens, seeking to leverage more advanced data and Internet of Things (IoT) environments to make more real-time operational decisions.

“The bottom-line is that stormwater management can no longer be an afterthought for municipal leaders and property owners as its potential impacts on local communities, infrastructure, and ecosystems are evident across all regions of the country,” notes Bindler. “Fortunately, stormwater is now gaining attention from policymakers, local government, and the supply chain.”

About this Report

This Insight Report and accompanying data dashboard provide a comprehensive evaluation of the U.S. stormwater infrastructure market landscape, including market drivers, trends, forecasts, and company profiles of 30 leading stormwater infrastructure and equipment suppliers. Bluefield U.S. & Canada Municipal Water clients can access this report here. Not a Bluefield client? This report + data are available for purchase.

Read more from Bluefield Research.